Exclusive data from Google: Keynotes from the CEE Startups presentation in Lisbon

12. 12. 2022 AutorIn November, the fifth edition of the Lisbon Beyond Summit 2022 took place in Lisbon. Google for Startups, Dealroom.Co, Atomico, and Credo Ventures prepared an exclusive presentation on Central and Eastern European startups. The data and insights were truly remarkable and will be appreciated by anyone interested in or considering online expansion into CEE region.

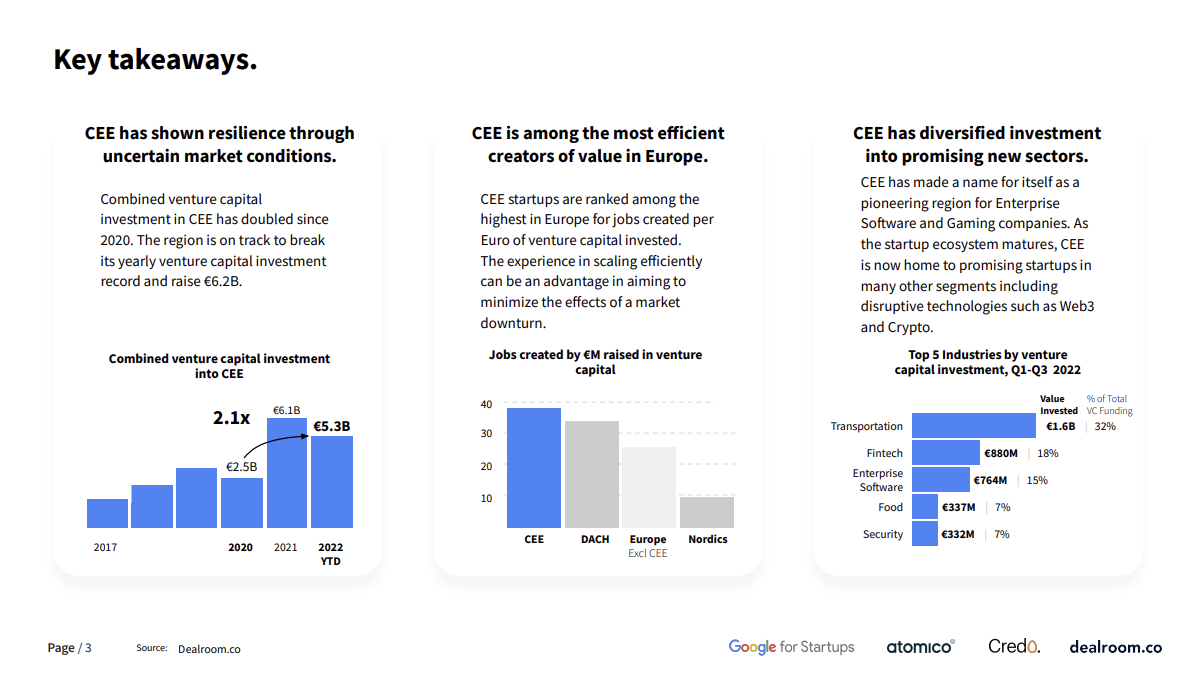

How is the CEE region doing? 3 main points from the authors

The authors began the presentation with a few key ideas, arguing that:

- Even in uncertain times, the CEE region has demonstrated resilience to market conditions.

- CEE countries create the most jobs per million euros raised in venture capital.

- Investment in CEE is diversified into new thriving sectors in the economy.

The CEE region has been growing the most over the last 5 years, with the transport and logistics sector leading the way in terms of investment.

The 66 slides of the presentation provided a wealth of data to read, including its interpretation. The data is mostly macroeconomic data, especially in the context of venture capital and startups.

As our team’s primary focus is on online expansion into the DACH & CEE region and digital marketing in these markets, the following information resonated with me the most:

- When comparing 2020 and 2022, we can already see a doubling of investment in startups in November. 2022 is thus very likely to catch up with 2021.

- The data speaks clearly and speaks of the transport/logistics sector as the most prosperous in terms of investment. This vertical is being pulled up by Rimac Automobili from Croatia or Bolt from Estonia.

- Over the last 5 years, the CEE region is growing the most (7.6x this year compared to 2017). Ambitious Nordic 3.8×, DACH 2.9×, but on a smaller unit basis (CEE €5.3 B × DACH €14.7 B). I wonder when CEE will get to DACH’s level.

- The Czech Republic is one of the hubs of startups. In the last five years, we have grown 4.4x, specifically from €6.9 B to €30.2 B. We are currently ranked 7th in the CEE region.

- Meanwhile, there are 44 new unicorns in CEE. The Czech Republic has two – Productboard and Rohlik. Who else aspires to be on the list of unicorns is revealed in slides 15 and 16.

- The investment round from “Seed” to “Series A” sees startups from CEE entering with similar conversion rates to the rest of Europe. Simply put, startup ideas and the ability to raise large investments are therefore of similar quality/success in CEE as elsewhere in Europe.

- A total of 4 countries hold 70% of the total venture capital share in 2022.

- Estonia €1.4B; Czech Republic €1.1B; Croatia €865M; Poland €550M.

- Startup funding has, of course, a big impact on job creation. In 2022, Ukraine, Slovakia, Belarus, Slovenia, and Serbia created the most jobs. Of the CEE countries, the Czech Republic ranks last – partly this can be interpreted to mean that we are no longer “cheap labor”.

View the full presentation on Dealroom.co

The data was largely provided by Dealroom.co. On their website you can download and view the presentation in detail.

Let us know which data surprised you the most, and if you’re just short of crossing the border, put your online business in the hands of our international specialists. Get in touch with us for a free consultation and we’ll take care of the rest.

![Achieving 276% y-o-y Blog Traffic Growth with Topical Authority [Case Study]](https://www.evisions-advertising.com/yPVTOLUdUV/uploads//2024/08/e-blog__EN-1-280x210.png)

Komentáře